Switch closes back-to-back ABS issuances in its first securitization offerings

LAS VEGAS — June 24, 2024 — Switch, the premier provider of AI, cloud and enterprise data centers, today announced the successful completion of two consecutive, asset-backed securities (ABS) transactions. The inaugural ABS issuance, totaling $752 million closed March 14, 2024, followed by the second issuance of $940.3 million, which closed on June 17, 2024. These two issuances make Switch the largest data center ABS issuer year-to-date with a total of nearly $1.7 billion.

“Successfully executing these transactions marks a strategic milestone in the evolution of Switch’s capital structure, giving the company access to new investors, additional borrowing capacity and a lower overall cost of debt,” said Thomas Morton, President of Switch.

“Capitalizing on the strong investor demand, we were able to execute both transactions with oversubscription levels across all classes of our bonds and on the second issuance we were able to tighten pricing across our Class A and Class B bonds,” said Madonna Park, Chief Financial Officer of Switch. “Given the success of these two issuances, combined with our robust portfolio of development and stabilized assets, we expect to continue to be an active issuer in the ABS market.”

Net proceeds after transaction fees and expenses will be used to refinance a portion of company’s take-private mortgage loan, which was put in place at the time Switch was acquired by DigitalBridge and IFM Investors in December 2022.

A wholly owned subsidiary of Switch, ABS Issuer, LLC established its Master Trust March 14, 2024, with the closing of its first issuance of $752 million. The offering included two classes of notes, $657.6 million of Class A and $94.2 million of Class B. All notes were rated by DBRS-Morningstar with the Class A notes rated A(low) and the Class B notes rated BBB(low). All series of notes in this issuance were designated as green bonds under International Capital Markets Association Green Bond principles in accordance with Switch’s Green Financing Framework. The deal was led by Morgan Stanley who acted as the Sole Structuring Advisor.

Switch followed on its inaugural issuance in March, with the closing of its second issuance on June 17, 2024, for $940 million. The offering included three classes of notes, $671.5 million of Class A, $94.8 million of Class B and $174 million of Class C. All notes were rated by DBRS-Morningstar with the Class A notes rated A(low), Class B notes rated BBB(low) and Class C notes rated BB(low). All series of notes in this issuance were designated as green bonds under International Capital Markets Association green bond principles in accordance with Switch’s Green Financing Framework. The deal was led by Morgan Stanley and MUFG (Mitsubishi UFJ Financial Group) as Co-Structuring Advisors.

In addition to Co-Structuring Advisors Morgan Stanley and MUFG, TD Securities (USA), LLC and RBC Capital Markets, LLC, acted as Joint Bookrunners. Société Generale, Truist Securities, Scotiabank, Santander, Citizens Capital Markets, Goldman Sachs and Guggenheim acted as Passive Bookrunners. ING, Natwest Markets, Standard Chartered Bank and Zions Capital Markets acted as Co-Managers.

###

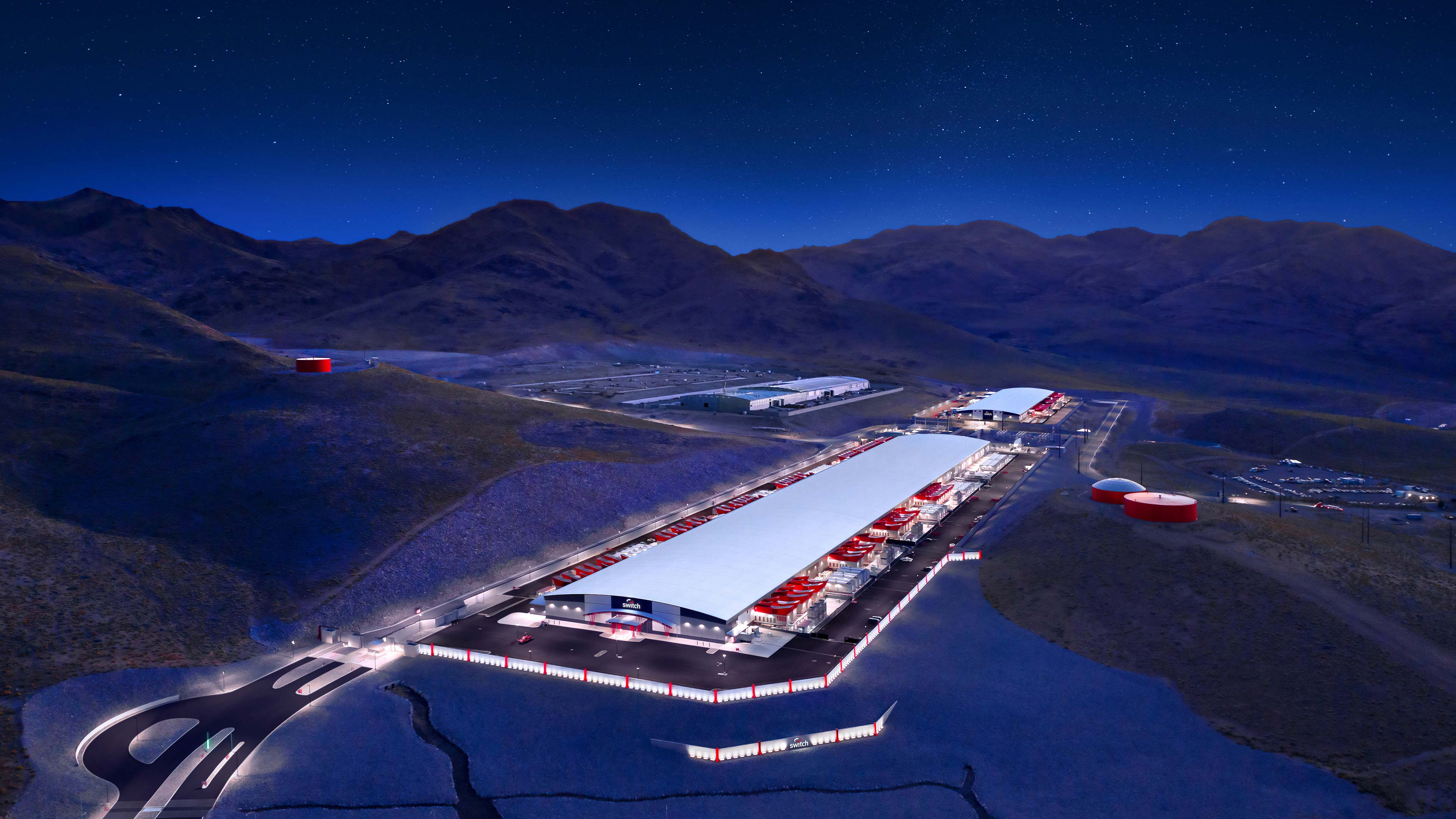

About Switch

Switch, founded in 2000 by CEO Rob Roy, stands at the forefront as the premier data center designer, builder and operator, owning 100% of its land and facilities. As the AI, cloud and enterprise data center experts, Switch delivers unparalleled solutions for the most discerning clients worldwide. With a commitment to robustness, scalability and sustainability, Switch offers a comprehensive portfolio encompassing highly dense, liquid-cooled AI environments, hyperscale cloud infrastructure and industry-leading, highly secure enterprise data centers. To learn more, visit switch.com and connect with us on LinkedIn, Facebook and X.