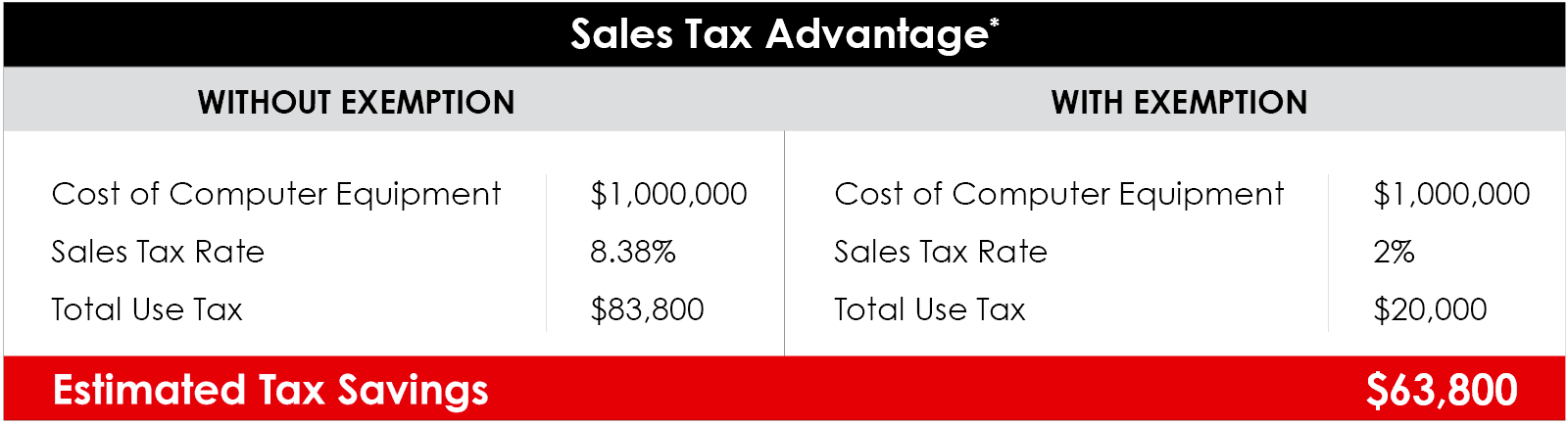

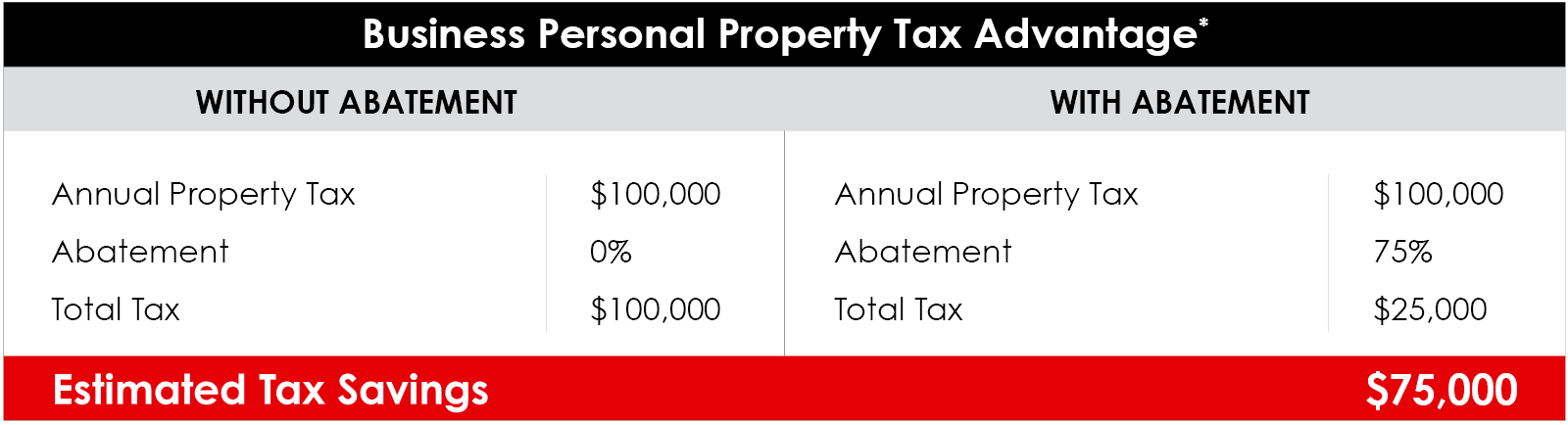

When you colocate in Switch LAS VEGAS or Switch TAHOE RENO, you may qualify for an abatement allowing you to only pay a maximum of 2% use tax on purchases of data center equipment. You will also benefit from a 75% abatement of local business personal property tax. Switch’s Tier 5® Platinum exascale data center facilities make Switch the highest-rated and most cost-effective colocation environment in the industry.

How to Qualify for the Abatement

- Contract with Switch for a minimum of 24 months

- Maintain a current Nevada State Business License

- Register with the Nevada Department of Taxation

How to Apply for an Exemption Certificate

Submit a copy of your Nevada State Business License and executed copy of the Certification of NV Colocated Business to [email protected]. Switch will prepare and submit your application for participation in the abatement program to the Governor’s Office of Economic Development. Upon approval, the Nevada Department of Taxation will issue a tax exemption letter (approximately 4-6 weeks).

How It Works

Consumer Use Tax Exemption

Provide a copy of the exemption letter issued by the Nevada Department of Taxation (NV DOT) to your vendor and pay no sales tax at the time of purchase of data center computer equipment. Report any purchases of data center computer equipment on the Data Center Exemption Consumer Use Tax Return and remit the 2% use tax directly to the NV DOT.

Property Tax Abatement

File the required annual business Personal Property Declaration with the Clark County Assessor (LAS VEGAS) or Storey County Assessor (TAHOE RENO) for gear installed at Switch facilities. Based on the data provided in the declaration, the County will issue a bill for the property taxes due indicating the 75% abatement.

Contact Us

Additional questions? [email protected]

* These materials have been prepared for informational purposes only. All rates are subject to change without notice. This information should not be relied upon for, tax, legal or accounting advice.