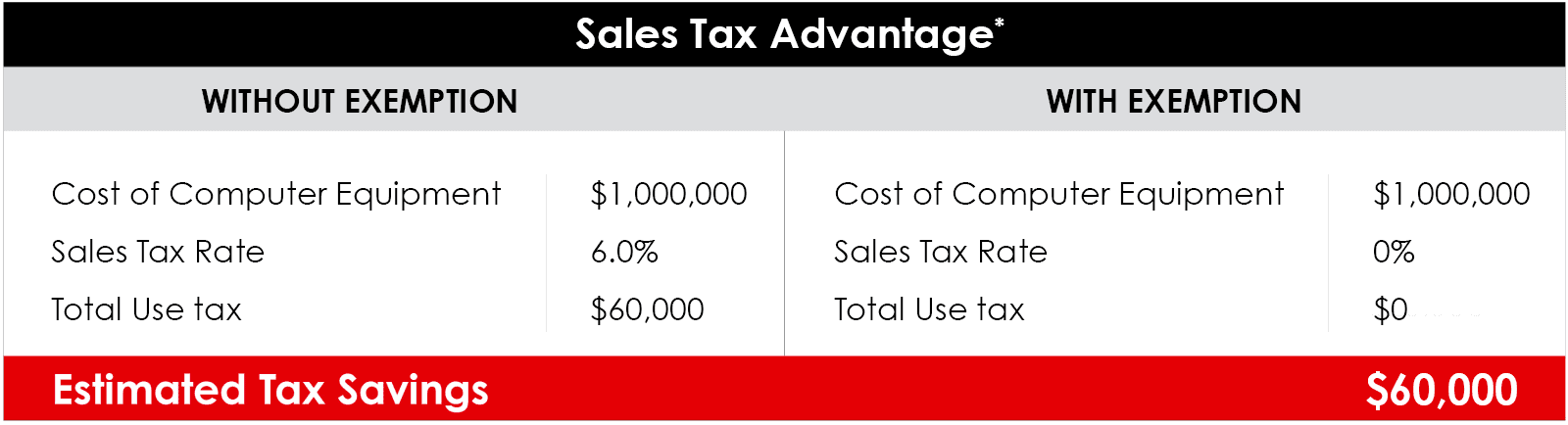

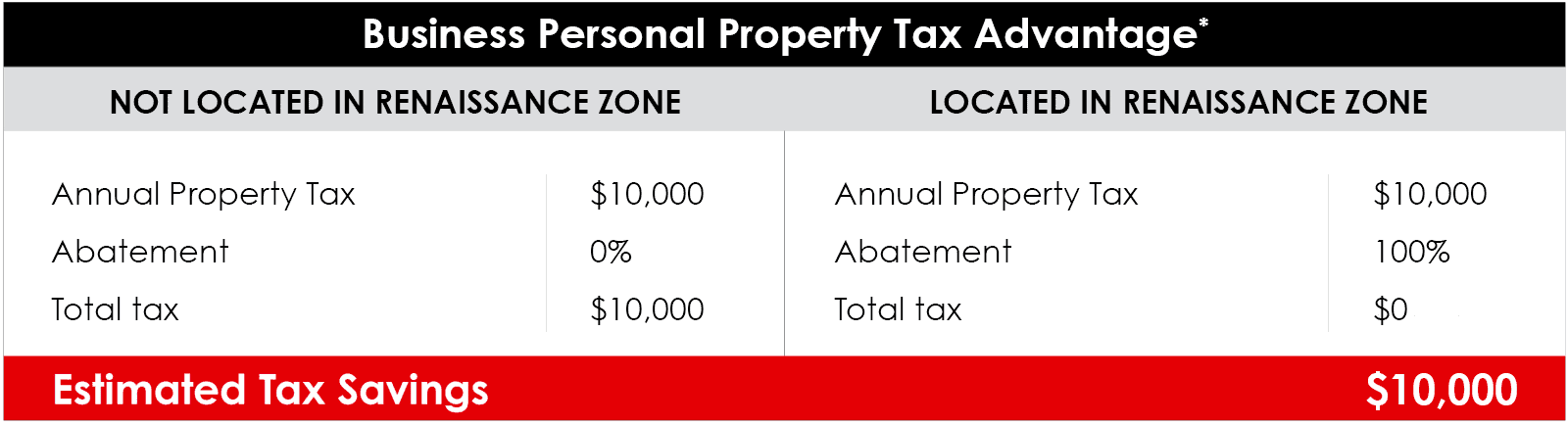

When you colocate in Switch GRAND RAPIDS, you qualify for a sales tax exemption on the purchase of data center equipment. Additionally, Switch GRAND RAPIDS is located in a Renaissance Zone allowing Switch clients to benefit from a full abatement of state and local business personal property tax for computer equipment located at this campus. Switch’s Tier 5® Platinum exascale data center facilities make Switch the highest-rated and most cost-effective colocation environment in the industry.

How to Apply for an Exemption Certificate

There is no application process required to participate in the Michigan tax advantages.

How It Works

Sales Tax Exemption

Complete a Michigan Sales and Use Tax Certificate of Exemption, issued by the Michigan Department of Treasury, marking Box 12 and filling in Qualified Data Center in Section 3: Basis for Exemption Claim. Provide the completed certificate to your vendor and pay no sales tax on qualifying purchases.

Property Tax Abatement

File the required annual business Personal Property Statement with the Gaines Charter Township, for any business personal property installed at the Switch GRAND RAPIDS campus. Based on the data provided in the personal property statement, Gaines Charter Township will issue a statement indicating a full abatement of personal property taxes.

Contact Us

Additional questions? [email protected]

Resources

Michigan Treasury Notice

Gaines Charter Township

* These materials have been prepared for informational purposes only. All rates are subject to change without notice. This information should not be relied upon for, tax, legal or accounting advice.