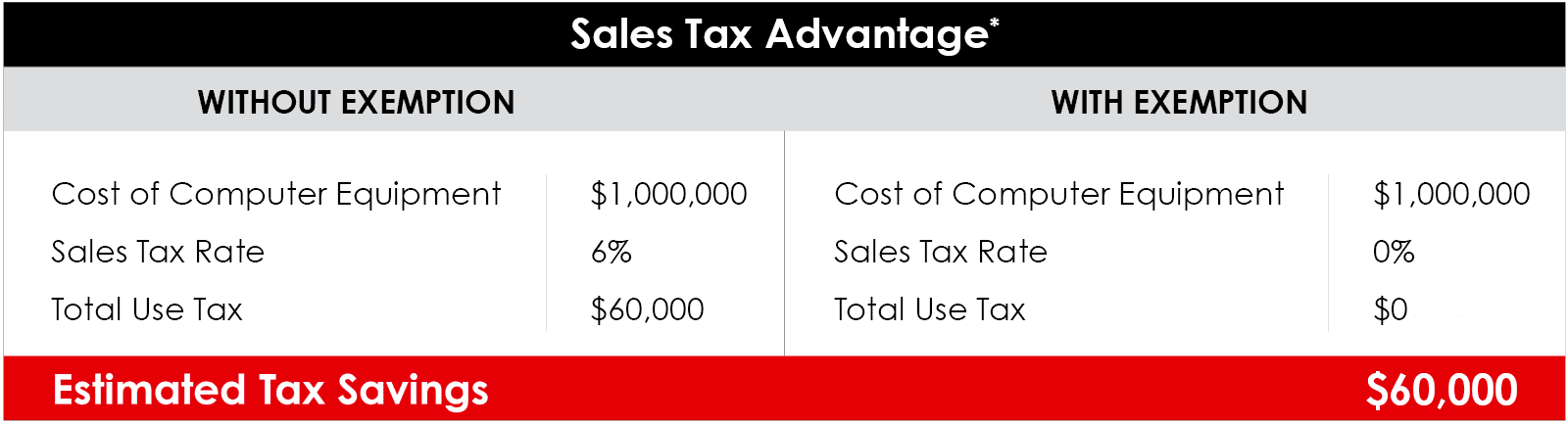

When you colocate in Switch ATLANTA, you may qualify for an exemption allowing you to obtain cost savings by having zero sales tax obligation on the purchases of data center equipment. Switch’s Tier 5® Platinum exascale data center facilities make Switch the highest-rated and most cost-effective colocation environment in the industry.

How to Qualify for the Abatement

- Contract with Switch for a minimum of 36 months

How to Apply for an Exemption Certificate

Click the following link for step-by-step instructions for how to apply for the exemption certificate:

How to Apply for High Technology Data Center Exemption Certificate

In order to complete the application you will need Switch’s Georgia sales tax number which can be requested by sending an email to [email protected].

How it Works

Sales Tax Exemption

Provide a copy of the exemption certificate issued by the Georgia Department of Revenue to your vendor and pay no sales tax on qualifying purchases.

Frequently Asked Questions

Are Switch clients required to make a minimum capital investment or establish a specific number of jobs within Georgia to qualify for the exemption?

No, Switch clients bear no responsibility for capital investment or employment required by the Georgia Department of Revenue.

What is the annual compliance requirement for Qualified Data Centers?

In accordance with Georgia state law, Switch is required to report the total amount of sales and use tax exempted by its clients for each calendar year. Switch will contact clients directly to obtain this information.

Additional Resources

Georgia Department of Revenue Policy Bulletin

Contact Us

Additional questions? [email protected]

* These materials have been prepared for informational purposes only. All rates are subject to change without notice. This information should not be relied upon for, tax, legal or accounting advice.