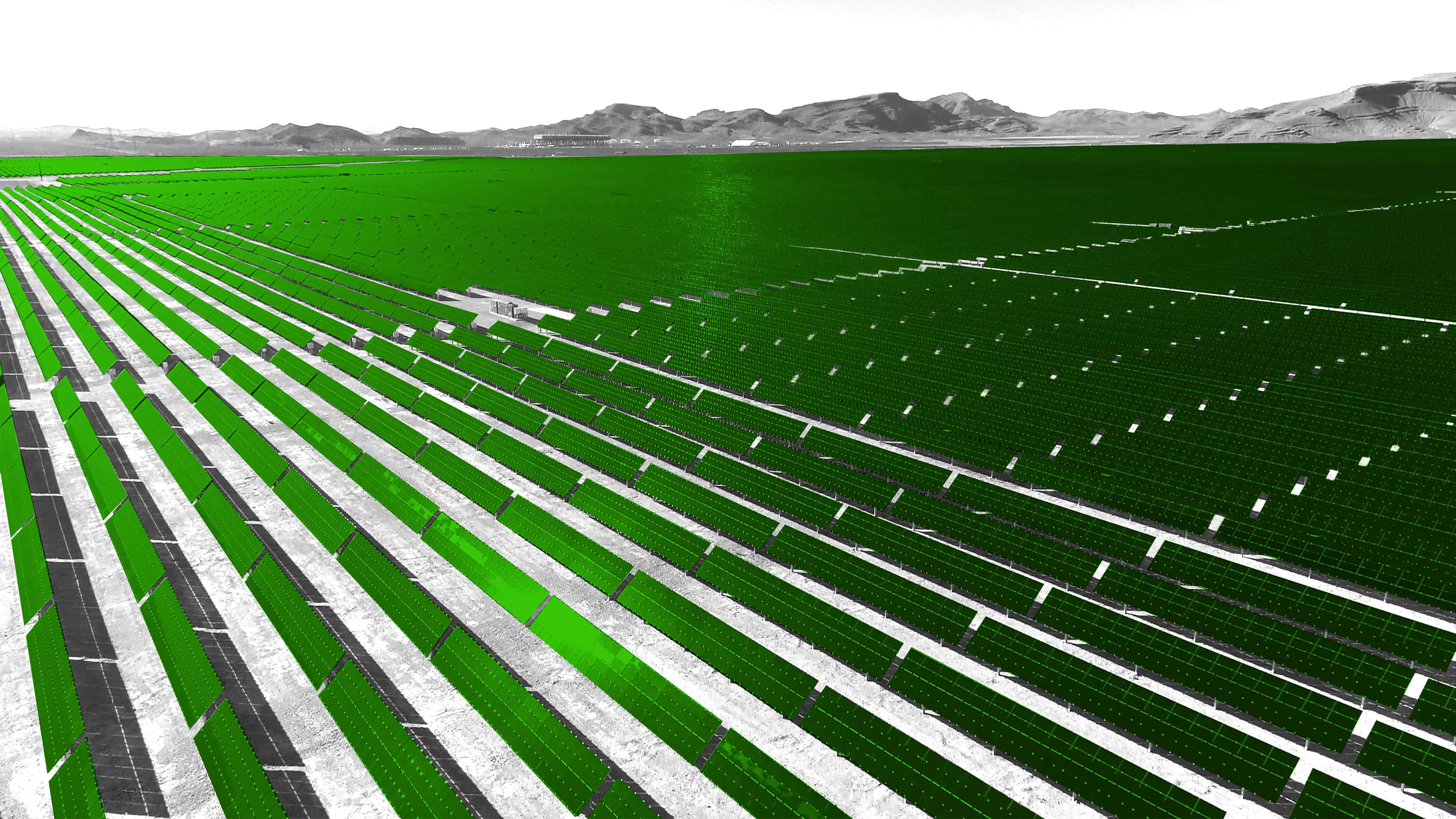

Solar Project Located in Boulder City, Nevada with Large-Scale Energy Storage Facility

NEW YORK – August 1, 2019: Capital Dynamics, an independent global private asset management firm, today announced that its Clean Energy Infrastructure (CEI) business has acquired the Townsite Solar Project, a 180MWac / 231MWdc solar project located in Boulder City, Nevada, through the acquisition of Skylar Townsite LLC. The Townsite project will also feature a 90MWac / 360MWh energy storage facility which will be one of the largest in the world. The transaction has closed and financial details of the transaction were not disclosed.

Three long-term PPAs to service two municipalities and a cooperative have been secured. The Townsite solar project is expected to be fully constructed by the end of 2021. The project is expected to create 300 jobs with a peak demand of 400 jobs during a 12-month construction period. The plant is expected to have 10 full time onsite and offsite employees.

The Townsite Solar Project is part of Gigawatt 1, one of the largest solar project portfolios in the world announced by Capital Dynamics, Tenaska Power Services Co. and Switch in February 2018. Gigawatt 1 aims to generate the lowest priced solar power in Nevada and generate enough clean energy to power nearly one million homes. The Gigawatt 1 concept comes from an initiative called Rob Roy’s Gigawatt Nevada, first proposed by Switch Founder & CEO Rob Roy four years ago.

“This major acquisition moves forward the overall vision of Rob Roy’s Gigawatt Nevada,” said Switch EVP of Strategy Adam Kramer. “Gigawatt 1 creates new clean energy jobs, the generation of new tax revenue for Nevada, important economic diversification, and strengthens our energy independence.”

“We would like to thank the Skylar team for working with us on one of the most complex renewable energy investments we have done to date. Townsite is an important project which is part of our Gigawatt 1 commitment,” said Benoit Allehaut, Managing Director at Capital Dynamics. “We believe this is the first hybrid utility-scale solar and energy storage project serving fixed volume power purchase agreements. Our view is that this type of service represents the future of the renewable energy sector and we are glad to innovate and help the market mature to more customer-focused products and services.”

“We appreciate the relationship with Capital Dynamics and their vision for the Townsite Project. We look forward to working with Capital Dynamics to complete this project and our continued relationship focusing on innovative, long-term renewable energy deals,” said William O. Perkins III, President of Skylar.

Tenaska Power Services, the leading provider of energy management services to generation and demand-side customers in the U.S., will be the energy service agent for the project, assisting with the sale and purchase of surplus / deficit merchant power, battery scheduling, and energy management.

Capital Dynamics Clean Energy Infrastructure team is one of the largest specialized renewable energy investment managers in the world with approximately $6.1 billion of assets under management and 5.4 GW of gross power generation across more than 100 projects.[1]

###

About Capital Dynamics’ Clean Energy Infrastructure

Capital Dynamics’ Clean Energy Infrastructure (CEI) team holds extensive expertise in investing, financing, owning and operating conventional and clean energy businesses globally. Established to capture attractive investment opportunities in this class of real assets, Capital Dynamics’ CEI mandate is to invest directly in proven clean energy technologies – such as solar, wind, biomass, conventional gas generation and waste gas-fueled power generation – across the globe. The CEI team currently manages 5.4 GW of gross power generation across more than 100 projects in the United States and Europe.[2]

About Capital Dynamics

Capital Dynamics is an independent global asset management firm focusing on private assets including private equity, private credit, clean energy infrastructure and clean energy infrastructure credit. Capital Dynamics offers a diversified range of tailored offerings and customized solutions for a broad, global client base, including company, family offices, foundations and endowments, high net worth individuals, pension funds and others. The firm oversees more than USD 16 billion in assets under management and advisement.2 Capital Dynamics is distinguished by its deep and sustained partnerships with clients, a culture that attracts entrepreneurial thought leaders and a commitment to providing innovative ideas and solutions for its clients.

Founded in 1999 and headquartered in Zug, Switzerland, Capital Dynamics employs approximately 150 professionals2 globally and maintains offices in New York, London, Tokyo, Hong Kong, San Francisco, Munich, Milan, Birmingham, Dubai and Seoul. For more information, please visit: www.capdyn.com

About Switch

Switch (NYSE: SWCH), the technology infrastructure company headquartered in Las Vegas, Nevada is built on the intelligent and sustainable growth of the Internet. Switch founder and CEO Rob Roy has developed more than 500 issued and pending patent claims covering data center designs that have manifested into the company’s world-renowned data centers and technology solutions.

The Switch PRIMES, located in Las Vegas and Tahoe Reno, Nevada; Grand Rapids, Michigan; and Atlanta, Georgia (opening in Q4 2019) are the world’s most powerful hyperscale data center campus ecosystems with low latency to major U.S. markets. Visit switch.com for more information.

About Tenaska Power Services Co.

Tenaska Power Services Co. (TPS) is the power marketing affiliate of Omaha, Nebraska-based energy company Tenaska, one of the leading independent power producers in the United States. Tenaska is ranked by Forbes magazine among the largest U.S. private companies. TPS is a leading provider of energy management services to generation and demand-side customers in the U.S., with more third party-owned generation under management than any other provider. TPS specializes in physical power marketing and electric asset management for utilities and non-utility generators. Based in Dallas, Texas, TPS operates a 24-hour, seven-day-a-week electricity trading floor.